Tesla’s stock is stupidly pricey. It might go higher and investors may be rewarded, or it might languish or fall.

There is no law forbidding stupidly pricey from ending up being moronically costly. Moreover, a speculative business that achieves explosive sales and revenue development for a variety of years can make outlandish evaluations appear justified for a time.

The issue comes when wonderful expectations dissatisfy and worried shareholders look down to find the thinnest of thin air beneath them.

Shares of the electric car maker were included in the S&P 500 Index last week and struggled. However, they are still up an impressive 690% this year and now has a market worth of nearly $617 billion.

The current appraisal makes Tesla the sixth-largest company in the S&P 500, and by any metric, shares of this company are expensive.

The price-to-earnings multiple for the general S&P 500 is currently about 22.3 times the consensus earnings price quote for 2021. Tesla shares are trading at more than 168 times.

It is real that TSLA’s earnings are forecasted to grow at a fast speed over the next several years, but shares are still priced at 77 times the consensus 2024 quote. If that sounds costly, have a look at price-to-sales multiples. The average price-to-sales ratio for the S&P 500 is 2.7 x while Tesla is at over 13x!

What could fail

A few hot-concept momentum stocks really do work out and become amazing long-term financial investments.

However lots of more do not, and the high-profile success stories that are Apple and Amazon, and Microsoft can trigger investors to justify their decisions to follow the herd, neglect evaluations, and effectively toss caution to the wind.

Share rates have soared, but is this a magnificent financial investment opportunity at a market appraisal of $616 billion?

The business is now worth more than double the combined market assessments of Ford, GM, and Toyota! Could it at some point deserve triple? Possibly.

One thing makes sure to take place though; whichever path rates follow– up or down– choruses of Wall Street wags will sing the “Of course I understood it” hymn. History is irritatingly apparent once it becomes history.

Believe prior to your purchase

Considering buying Tesla shares? 2 points: all else equivalent, when you buy stocks at high appraisals, your expected future returns are going to fall.

Second point: all high-growth businesses start trading in anticipation of big future growth.

When that development successfully materializes, as it has for a business like Amazon, Facebook, etc. all is well. However, for each Amazon and Facebook, there is a slew of companies that struggle just to endure their very first financial downturn.

The point is that to build a company as successful and Amazon, Microsoft, and Tesla, magnificent concepts and impressive execution requirement to be combined with great fortune and exceptional timing.

The late 1990s dot-com gold mine was rife with incredible, sparkling business never ever heard of before nor spoken with since. However, they didn’t make it to Tesla’s status.

Why Tesla is not special

My buddy Jim Cramer just recently suggested on CNBC that Tesla deserves a halo that other companies just don’t be worthy of.

Jim stated that “Tesla is the stock that broke how we see stocks. It’s a completely non-traditional method to look at stocks, and more youthful people take a look at a company that can make a battery and they dream dreams. They do not go with the spreadsheet. They see things that we don’t see.” However, dreams do not survive long without spreadsheets.

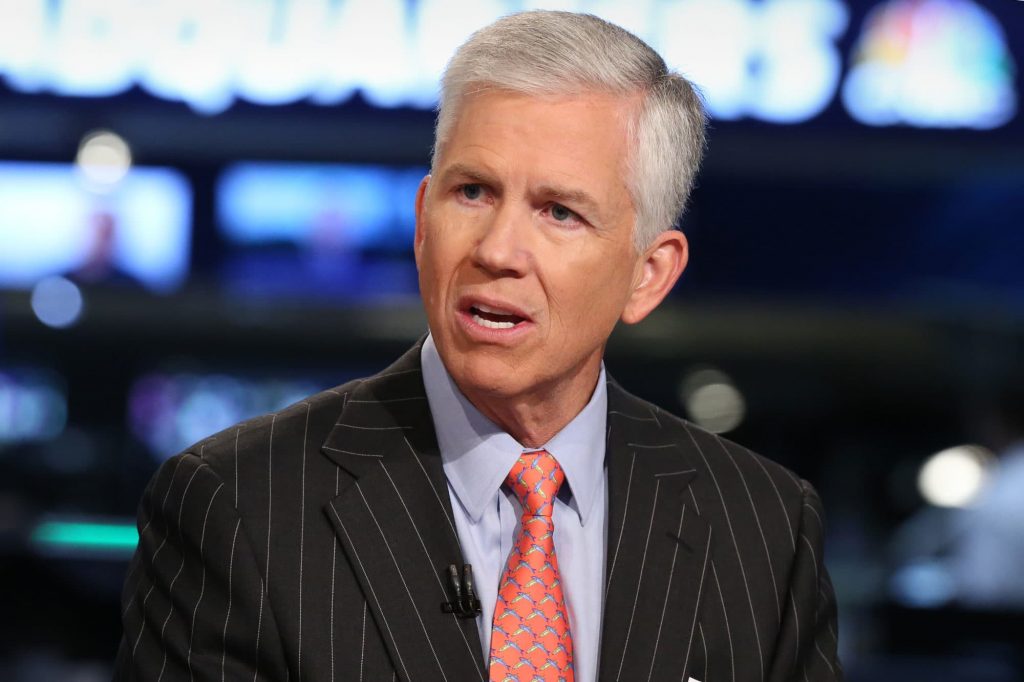

As my pal, Seabreeze Partners’ Doug Kass believes, “Tesla has a shallow moat. Adjusted for the sale of emission credits, Tesla has never paid in its 17 years of presence (in spite of having no competitors and any need for advertising.)”

The trailblazer for principle alchemy is Amazon. Amazon was the nascent online bookseller in the 1990s that encouraged Wall Street that incomes didn’t matter.

As long as the principal continued to make good sense and top-line development was strong, Bezos was complimentary to construct a leviathan retailer not strained by pesky things like earnings or capital. It was a snow job worthwhile of P.T. Barnum, and it worked. Amazon shares skyrocketed, though positive revenues were 15 years into the future, and after that only since of a completely different service line (cloud storage).

However, for every Amazon, there are numerous brief darlings like JDS Uniphase and Pets.com. In the early minutes of concept-driven rapture and the extrapolation of high development rates several years into the future, all things are possible.

Dreams are why people play the lotto, and lotto outcomes are why states run them and create millions in revenues.

A rough gamble

Tesla has currently been an amazing success for investors, and it might exercise as a fantastic long-term stock one day. However, when stocks become this costly, there is far, far less margin for mistakes.

Tesla at these levels is more dependent on momentum investing and the “higher fool” theory than anything else right now. It is much too speculative for financiers like us.

If somebody intentionally desires to roll dice, Tesla might work.

My longstanding guidance to gamblers is to go to Las Vegas! At least when you lose in Vegas, they’ll comp you a complimentary cocktail.

For most folks, cash is hard to make and harder to save. Disciplined, dispassionate investing constructs wealth with time. Farr’s guidance is to leave betting to bettors and focus on ending up being a much better investor.